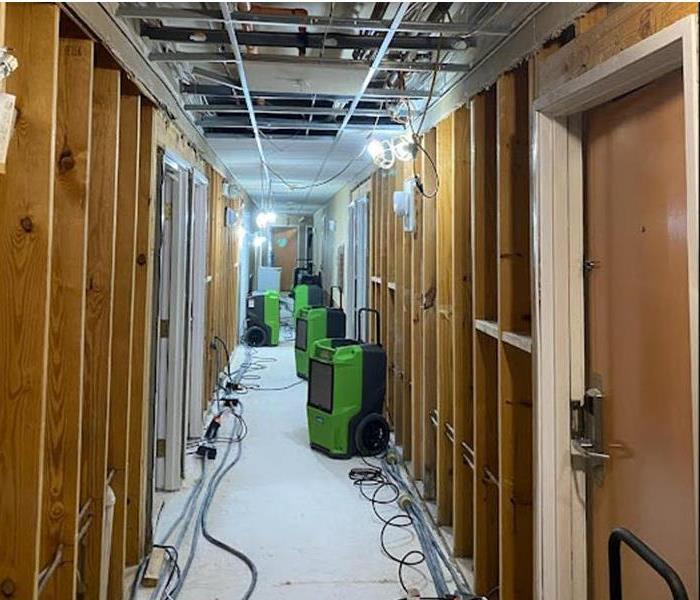

Water Damage

8/25/2022 (Permalink)

There are a number of ways that water can damage your home, including burst pipes, ground seepage, sewage backups and natural disasters like hurricanes or floods.

Not all instances will be covered by most homeowner’s policies so it’s important to understand what water damage to claim on insurance and what kind of coverage you really need.

When it comes to water damage what will insurance pay for is the first question most people ask

Most homeowner’s policies cover water damage that is sudden and originates inside the home.

This includes scenarios like burst pipes and water damage caused by the fire sprinkler system or by vandalism. Damage that originates outside the home, such as water seeping in through the foundation or sewage main backups are generally not covered.

The other type of damage that is not covered by a standard homeowner’s policy is what is termed “gradual” damage.

This is water damage that results from lack of regular maintenance. For instance, if your roof was in a state of disrepair and that lead to a leak, that wouldn’t be covered because you failed to maintain the condition of your roof.

There are additions, called endorsements or riders, that you can make to your standard policy to cover specific kinds of damage not directly covered.

Endorsements address things like mold/fungus and flooding or other natural disasters.

Whether you actually need these riders will depend on the area where you live and whether it is prone to severe weather conditions.

Call us here at SERVPRO we are here 24-7-365

24/7 Emergency Service

24/7 Emergency Service